So it facts is written by Investigative Opportunity towards the Battle and you may Collateral, hence focuses on introducing logical racism, if you are degree journalists with the study-motivated journalism. It is getting authored because of a collaboration with Block Club Chicago, an effective nonprofit newsroom worried about Chicago’s neighborhoods.

This new concrete stairs so you’re able to her Rosemoor household, in which the woman is existed just like the sixties, urgently you would like repairs. Harris, 64, provides restricted flexibility immediately after suffering a stroke, and you will this lady has to utilize excrement locate up and down.

Harris called the city for assist, nonetheless informed her there was an effective around three-year-long prepared record. She concerned about the fresh new waiting.

Then, new city’s Household Resolve program, which provides reduced-income property owners that have rooftop and you may deck fix provides, sent Harris a contact so it times confirming she are desired so you’re able to upload first records. She expectations it’s an indicator works can begin in the near future. Immediately following that is finished, she would wish change the tub from inside the a full bathroom with a shower that will allow their unique so you’re able to effortlessly be in and you will out.

Anywhere between 2018 and you will 2022, Black locals 62 and you may earlier were twice as apt to be refused home loans as his or her light competitors during the il, a diagnosis regarding Mortgage Revelation Act investigation by the Investigative Venture with the Race and you may Security reveals. More than that point, 48% out of Black the elderly along the urban area was basically declined a mortgage compared to 23% off light individuals, the info inform you.

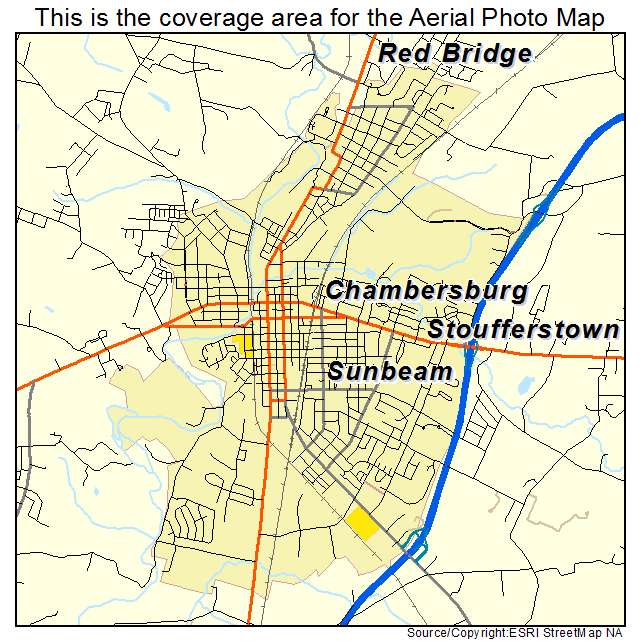

Per $step 1 approved so you can older people in order to provide security by way of an excellent refinance or home improvement mortgage on South Deering neighborhood area in which Harris lifetime, $20 are accepted to have elder home loan applicants for loans for bad credit in Poncha Springs the Norwood Playground, based on an analysis of the federal analysis

Chicago’s heritage out of racial segregation and redlining by the banking institutions continues to influence home prices and usage of mortgage lending, and the elderly, especially in the brand new city’s predominantly Black colored groups, tapping into their home guarantee or refinancing will be a problem. Societal apps don’t have the resources to fulfill the brand new consult, and in place of investment from private loan providers, a number of the fixes is certainly going unaddressed, pros state.

Because of this, land often weaken, including blight to your area and probably blocking older people, instance Harris, out-of aging securely in their own residential property.

Elderly residents usually you desire tuckpointing to extend the life away from stone buildings, roof repairs and you can electronic and you can heat repairs, said Rev. Robin Hood, the newest manager manager of your own Illinois Anti-Property foreclosure Coalition. He’s noted for permitting the elderly focused backwards home loan frauds. More mature Black colored feminine have a tendency to contact your, and you will he’s seen extreme examples of homeowners struggling with fixes. Once, he aided a woman toward South side get a heating tool from the popular with the local news.

It was five less than zero available to you,” said Bonnet, a long time West Front activist. “We told you, [The city] allow the dated individuals perish.’

The fresh Chicago Service out-of Casing has actually eliminated delivering the newest apps, therefore the option solution is that loan

Residents commonly failed to afford preventative developments when they had been young and functioning, told you Amber Hendley, manager out-of look on Woodstock Institute. Of several property can be found in such as crappy updates on account of deferred maintenance, it today you need solutions whenever owners can be the very least afford they, she told you.

Harris, having five sisters, transferred to a nearby when she was in the 3rd stages. Their own father established their residence on crushed up. After their unique coronary arrest, her youngest aunt and her household members became their particular assistance system.

Past that have a place to stay now, getting the property means the opportunity to violation one thing right down to Harris’ relative and you may nephew, she told you.