A financial report home loan, called a self-operating financial otherwise a non-conventional financial, is a type of financial designed for those who have non-antique income papers otherwise was care about-employed. Instead of antique mortgages one have confidence in W-dos forms and you may taxation statements to ensure earnings, a bank report mortgage lets consumers to incorporate financial comments due to the fact proof money.

While you are wondering whether you could be eligible for a lender report mortgage, otherwise what your choices are to pursue homeownership, we’re here to greatly help. E mail us anytime!

Questioning exactly what the difference in a lender statement financial and you may an effective conventional mortgage try? There are several determining has actually.

Income Differences

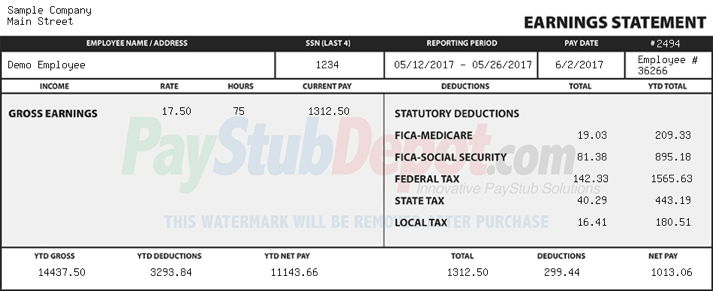

Traditional mortgage loans work for antique group with normal money. Put differently, they work well for somebody that will verify money with a good W-dos and you may pay stubs. When you’re notice-operating or a specialist, this really is easier said than done.

Self-operating anyone tend to deal with pressures whenever applying for a timeless home loan because their income may differ notably annually otherwise might not be easily recorded because of old-fashioned means. Bank report mortgages bring a viable solution by permitting these consumers to utilize their providers otherwise private lender statements to exhibit the capacity to pay back the loan.

Specific borrowers keeps income out of supply aside from worry about-a career that ework of a vintage mortgage. This might were local rental income, funding earnings, or royalties. Lender report mortgage loans are the ideal option for they as they accommodate a far more versatile and you may loan places in East Point alternative way of earnings confirmation.

Tax Generate-Offs

Self-working some body tend to make the most of individuals tax deductions and you may generate-offs to attenuate its taxable income. Although this will likely be useful regarding an income tax perspective, it might decrease the documented money towards taxation statements, possibly so it is much harder in order to qualify for a timeless home loan. A financial report mortgage considers the internet money mirrored regarding lender statements, delivering an even more exact signal of your borrower’s capacity to pay the loan.

Earnings vs. Paycheck

Bank report mortgage loans focus on the cashflow of debtor, making it possible for a more comprehensive analysis of money and you will expenses. So it liberty are going to be useful for folks who has actually seasonal earnings, unpredictable percentage dates, or significant motion within the month-to-month income.

It permits lenders to evaluate the borrower’s ability to pay back new loan according to their actual cash move instead of depending only toward a fixed earnings amount. We are going to look at several so you can a couple of years off bank statement to decide your general income rather than just looking at a latest spend stub otherwise income tax come back.

Smooth App Process

An alternate difference between lender statement and you can old-fashioned mortgage loans is the application processpared in order to conventional mortgage loans which need detailed documents, bank statement mortgages normally have a simplistic application techniques. Borrowers commonly expected to bring as numerous financial data files, such as tax statements, W-2 models, or pay stubs. This will save your time and relieve the fresh new administrative load, deciding to make the financial procedure more beneficial.

Most Variations

Bank statement money offer a method in order to homeownership having consumers whom are able to afford a home loan however, usually do not meet the requirements with conventional records. not, there are lots of most costs and you can opportunities regarding the a bank report financial that you need to remember:

- When you find yourself lender report mortgages may require less traditional income data files, consumers still have to promote intricate financial comments for the given months, usually twelve to help you couple of years. These types of comments is reveal uniform places and you can proper cashflow to demonstrate new borrower’s capability to repay the mortgage.

- Considering the detected greater risk of the low-conventional money verification, their financial statement mortgage can come which have a bit large interest rates compared to traditional mortgages.

- You may have to pay a bigger advance payment to possess a great bank statement financing when compared with a classic loan.