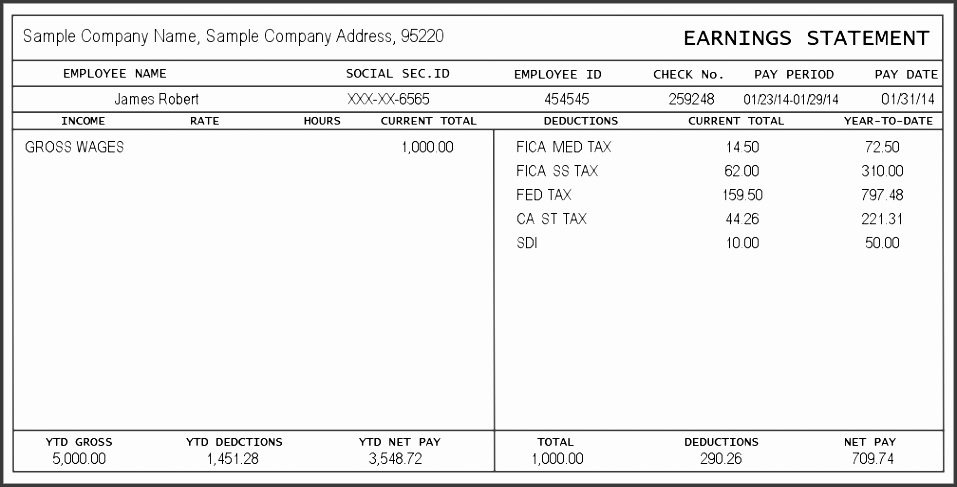

Kim are a self-employed contributor to Newsweek’s personal financing people. She first started their own profession on Bankrate content desk this season, has worked while the a regulating publisher at the Macmillan and you will ran full-time self-employed within the 2018. Since that time, she actually loan places Pine Lakes is created to possess all those publications also U.S. Development & World Report, United states Now, Borrowing from the bank Karma, AARP The new Journal and a lot more. She loves investing her free time training, running, cooking and hanging out with her members of the family.

Robert is actually an elderly publisher during the Newsweek, dedicated to a range of individual finance topics, and additionally handmade cards, loans and financial. Just before Newsweek, he did in the Bankrate due to the fact lead publisher to possess small company money so that as a charge cards copywriter and you may editor. He’s got plus authored and you may modified getting CreditCards, The newest Facts Guy additionally the Motley Deceive Ascent.

For the past half a dozen ericans have tried private financial insurance coverage (PMI) so you’re able to secure investment to their house. We inserted one to number from inside the 2020 when we bought our basic family from inside the Massachusetts.

When you find yourself PMI assisted us get the condo with a minimal down commission, in addition it included a few drawbacks. This new PMI extra $70 to the invoice, and it also doesn’t actually include us-it reimburses the lender if we end making payments towards loan.

This type of insurance policy is designed to expire after you spend away from a certain amount of the borrowed funds, however, there are ways to automate the procedure. I just removed PMI regarding 28 weeks prior to agenda, saving us doing $2,000. Here is what Used to do to abandon personal financial insurance coverage and how can be done a comparable.

All of our studies are built to give you a comprehensive expertise from private loans goods you to definitely work best with your needs. So you’re able to in the decision-and also make processes, our very own professional contributors contrast preferred choice and you may prospective discomfort issues, such as value, entry to, and credibility.

Vault’s Advice

- PMI is usually needed when you take away a normal conforming mortgage and place off less than 20%.

- Your loan servicer have to immediately miss PMI if the financial balance are at 78% of one’s residence’s price.

- One may terminate PMI other times, such as for example when your household worth has grown.

How i Got rid of PMI Of my personal Financial

Deleting private financial insurance rates out of my mortgage are a pretty easy techniques. It on it giving a few letters and working that have a real home elite to determine the house’s well worth. And you can we performed a small amount of creating work in first. End-to-end, the process took about 2 weeks and cost $190. Here’s how i did it.

We monitored Our home Equity

Just after preserving into the buy, i ordered our very own property into the 2020 to have $360,000 with an effective 7% down-payment. We from time to time searched assets-worthy of other sites and you can pointed out that our property value had sprang to $505,000 because of the .

For the COVID-19 pandemic, he states, more individuals were able to real time and you may work everywhere. Most of them transferred to different section to get lower construction or be close friends and family.

We Crunched the new Number

By-law, the loan servicer must lose PMI when your home loan equilibrium is actually booked to arrive 78% of the home’s cost. Our mortgage was booked to-arrive this threshold when you look at the .

Because the house really worth ran right up, the house equity enhanced also. We commercially fulfilled the brand new endurance to eradicate the borrowed funds insurance rates. However when your residence well worth appreciates, it is its up to your own home loan servicer and their guidelines on the just how to eliminate PMI, Schachter claims.