Glen Luke Flanagan is a deputy editor in the Fortune Suggests which targets home loan and you can charge card stuff. His past jobs is deputy editor positions on United states of america Today Blueprint and you can Forbes Coach, and senior copywriter within LendingTree-every worried about bank card rewards, fico scores, and you may associated subject areas.

Benjamin Curry is the director off blogs during the Fortune Advises. With over twenty years out-of journalism feel, Ben has actually why not look here generally shielded financial avenues and private financing. In the past, he was an elderly publisher at Forbes. Ahead of that, he worked for Investopedia, Bankrate, and you may LendingTree.

The current average interest rate getting a fixed-speed, 30-year compliant real estate loan in america is actually 6.107%, depending on the current investigation supplied by financial technology and study business Optimum Blue. Continue reading observe mediocre rates for different brand of mortgages as well as how the modern cost compare with the final reported day previous.

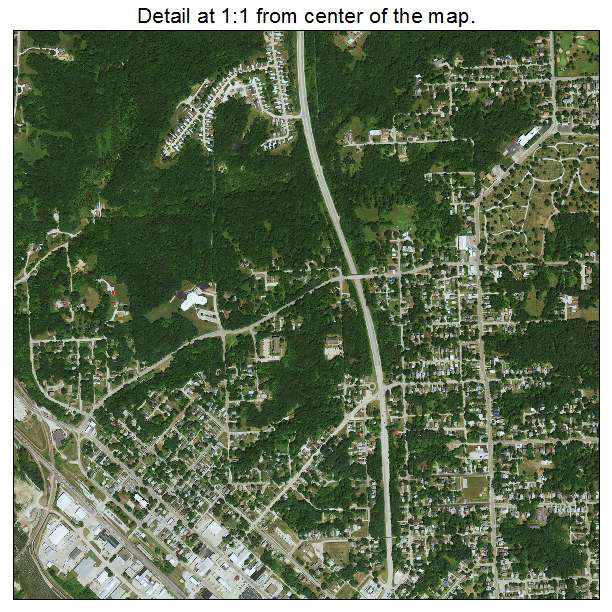

Historical mortgage cost chart

Notice, there clearly was a slowdown of a single business day within the studies revealing, meaning that the most current rates currently is what the brand new chart suggests for Sep 23.

30-year conforming

The typical rate of interest, for each probably the most newest study available as of this composing, are six.107%. Which is right up away from 6.062% the past said time earlier in the day.

30-12 months jumbo

What exactly is a great jumbo home loan or jumbo financing? Quite simply, it is higher than the most to have a routine (conforming) home loan. Federal national mortgage association, Freddie Mac computer, and Government Construction Loans Agency set this limitation.

The average jumbo mortgage rates, for each and every the absolute most current research available during that composing, are six.492%. That’s up regarding six.347% the past claimed date early in the day.

30-seasons FHA

The fresh new Government Homes Administration brings financial insurance policies to particular lenders, therefore the lenders subsequently could offer the user a much better deal to your facets including having the ability to qualify for a good mortgage, possibly and make a smaller deposit, and possibly getting a diminished rate.

The common FHA mortgage rates, per more latest investigation offered at this composing, try 5.900%. Which is right up off 5.825% the last claimed date past.

30-season Virtual assistant

An excellent Va mortgage exists because of the a personal financial, but the Agency of Pros Points claims element of it (cutting exposure towards financial). They are obtainable if you are an excellent U.S. army servicemember, a seasoned, or an eligible thriving spouse. For example fund get both allow acquisition of property with no down-payment whatsoever.

The average Va home loan price, for each the absolute most most recent study readily available at this composing, are 5.522%. That is up from 5.487% the past said big date earlier in the day.

30-year USDA

This new U.S. Institution from Farming operates apps to simply help lower-earnings candidates reach homeownership. Such as money can help You.S. customers and you will qualified noncitizens purchase property no down-payment. Note that you’ll find strict criteria to be able to meet the requirements to own good USDA financial, like money constraints in addition to domestic being in an eligible rural urban area.

The common USDA financial price, for every single more newest data available at the composing, was 6.024%. That is up out of 5.850% the past stated go out early in the day.

15-season financial costs

An effective fifteen-season financial often generally speaking mean highest monthly premiums however, smaller appeal paid back over the lifetime of the borrowed funds. The typical rate to have a great 15-seasons conforming home loan, for each the essential newest study available at the composing, was 5.273%. That’s upwards from 5.177% the very last claimed time prior.

Why do mortgage rates change?

If you find yourself your very own borrowing from the bank profile rather affects the mortgage rate you will be provided, certain external circumstances also play a part. Trick impacts are: