At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records. In accounting, journals are used to record similar activities and to keep transactions organized. Because you have already received the cash at the point of sale, you can record it in your books.

Bookkeeping

As they are posted, the account numbers are placed in the post reference column. The length of time you should keep a document depends on the action, expense, or event the document records. Generally, you must keep your records that support an item of income or deductions on a tax return until the period of limitations for that return runs out.

Sales journal with a “sales tax payable” column

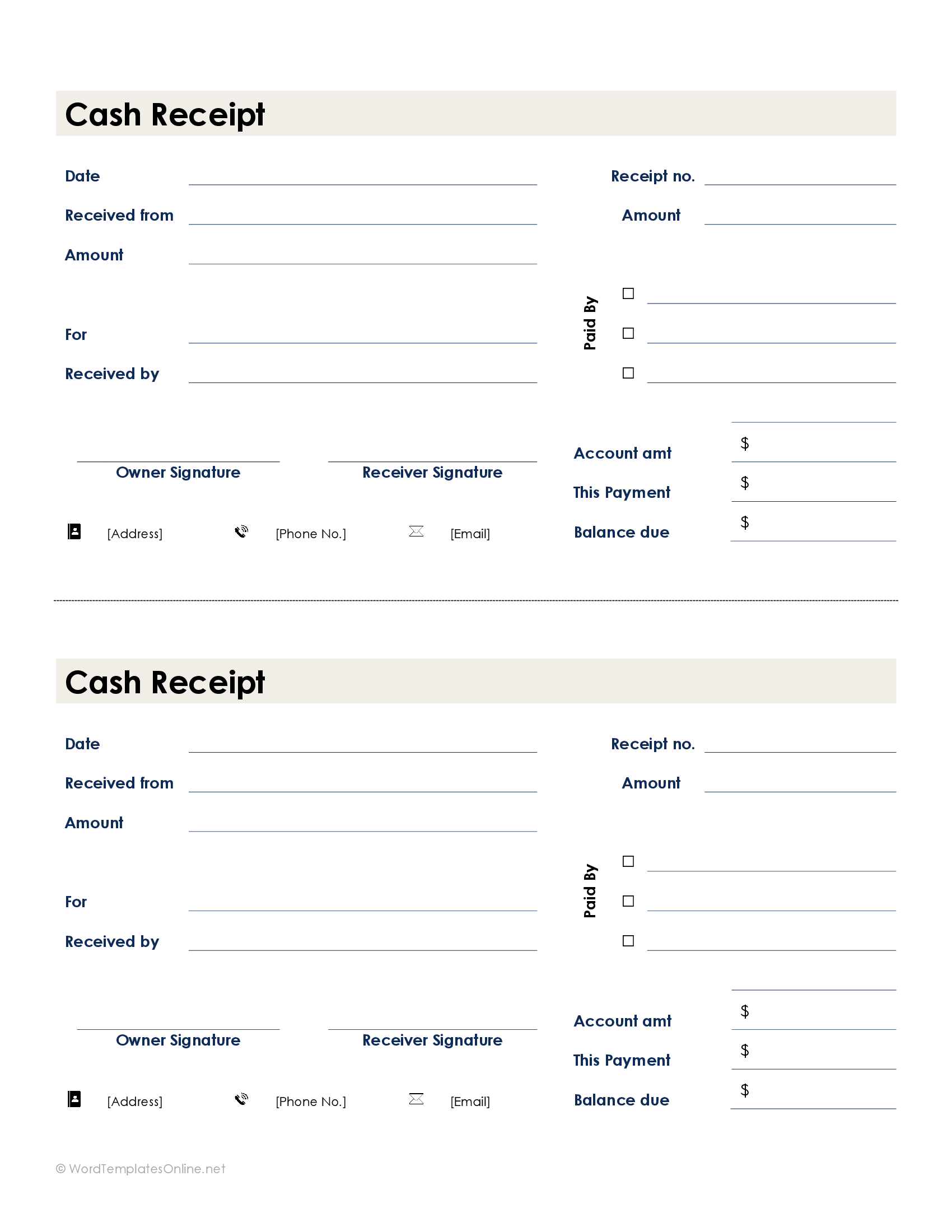

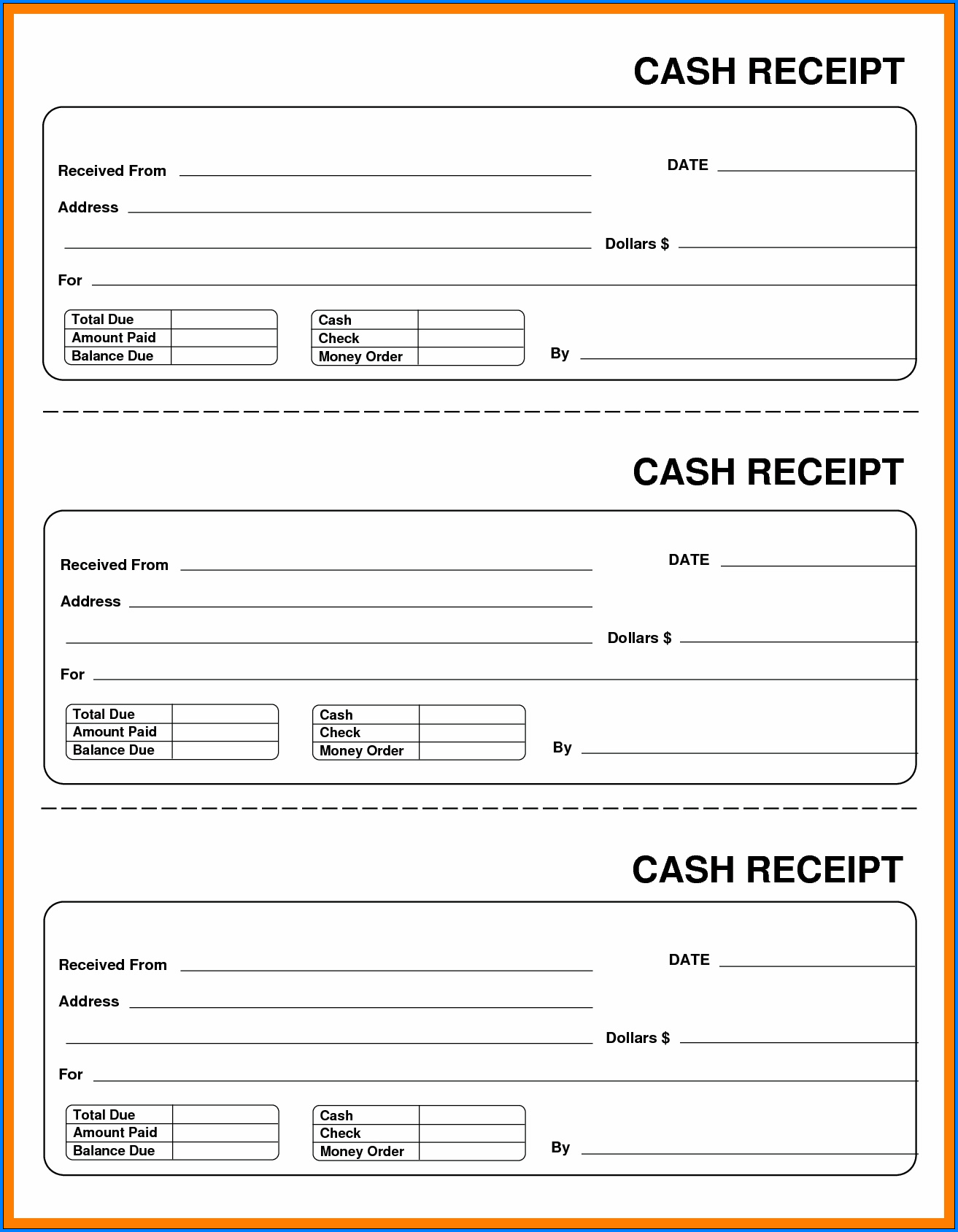

Using your sales receipts, record each cash transaction in your cash receipts journal. To ensure your books are accurate, you need to understand cash receipts accounting. Read on to get the inside scoop about managing and recording cash receipts in your small business. You calculate your cash receipts journal by totalling up your cash receipts from your accounts receivable account. As an accounting entry that records the receipt of money from a customer, a cash sales receipt is a debit.

Single Column Cash Book

The most common examples are the single, two and three column cashbooks, however, it is possible to have multi-column cash books, such as the petty cashbook, which can be used to provide further analysis of receipts and payments. It should be noted that when the cashbook is used as a subsidiary ledger the discount column is still not part of the double entry. The column simply lists the discounts as with invoice templates for free any other book of prime entry. Subsequently at the end of the accounting period, the business posts the total of the column to the general ledger discount allowed or received account as appropriate. You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day.

To help you understand the recording procedure, a simple format is given below. Manual accounting systems will likely use special journals for recording routine transactions. Accounting principles help govern the world of accounting according to general rules and guidelines. It is important to understand that if any cash is received, even if it relates only to a part of a larger transaction, then the entire transaction is entered into the cash receipts journal. To log these transactions in a cash receipts journal, each of these transactions is entered sequentially into the journal in the appropriate column. The cash book is a chronological record of the receipts and payments transactions for a business.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- The credit columns in a cash receipts journal will most often include both accounts receivable and sales.

- Recording cash receipts offsets the accounts receivable balance from the sale.

- For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used.

- Credit sales are not recorded in this accounting journal because there isn’t any cash collected in those credit sales transactions.

The cash receipts journal ignores the accrual basis of accounting, which serves as the foundation for sound accounting and double-entry bookkeeping. The cash receipts diary also contains information on any additional loans that a person has taken out from banks or other financial institutions. Tax refunds for direct and indirect taxes, any fee or commission collected, or the maturity of an investment or insurance policy. The cash receipts journal is used to record all transactions that result in the receipt of cash. A cash receipts journal is a special journal used to record cash received by a business from any source.

Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed. Purchase credit journal entry is recorded in the books of accounts of the company when the goods are purchased by the company on credit from the third party (vendor). Special journals (in the field of accounting) are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases. Cost of sales is also known as the cost of goods sold, and the two terms are used interchangeably.

The business can use the additional column to operate as a discounts journal. This columns records details of discounts allowed on the cash receipts side of the cashbook and discounts received on the cash payments side of the cashbook. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal. One of the journals is a cash receipts journal, a record of all of the cash that a business takes in.

A general journal is used to record unique journal entries that cannot be processed in a more efficient manner. For example, checks written, sales invoices issued, purchase invoices received, and others can be recorded in a computerized accounting system when the documents are processed. The balance in the cash receipts journal is regularly summarized into an aggregate amount and posted to the general ledger. At a minimum, the transactions in the journal should be posted to the general ledger at the end of each reporting period, though posting may be conducted on a daily basis.