- Danger of property foreclosure: The most significant downside is when you are not able to make your domestic collateral financing costs try a risk of foreclosure towards the possessions your put since the security.

- Possibly higher costs and fees: When you are family collateral money can offer lower rates than simply particular solutions, that isn’t always genuine getting funding functions. Lenders get examine these types of once the riskier, so you may deal with high cost and costs than a home equity mortgage on your own number one residence.

- Stricter conditions: Loan providers be cautious with money spent, so you’ll likely face stricter qualification conditions whenever applying for a great household collateral financing. They like to see a strong credit score, adequate income best banks for small personal loans, and you can adequate equity about property to help you justify the loan.

- Variable rate of interest: Really assets credit line fund has variable interest levels, meaning the monthly obligations you certainly will improve if your rate of interest goes up. This can make cost management and believed more difficult.

Whom has the benefit of HELOCs for the funding characteristics?

While many loan providers promote HELOCs you can use for your primary household, the choices to have loan providers happy to continue a HELOC into financing property can be more restricted. Below are a few it is possible to loan providers you can method:

1. Local and you can federal finance companies

Begin your pursuit which have regional and national banking institutions. Regional banking companies often offer personalized services and you may freedom, if you are national financial institutions render a wide array of lending products and you can comprehensive communities. Examining one another makes it possible to discover very positive words to have your needs.

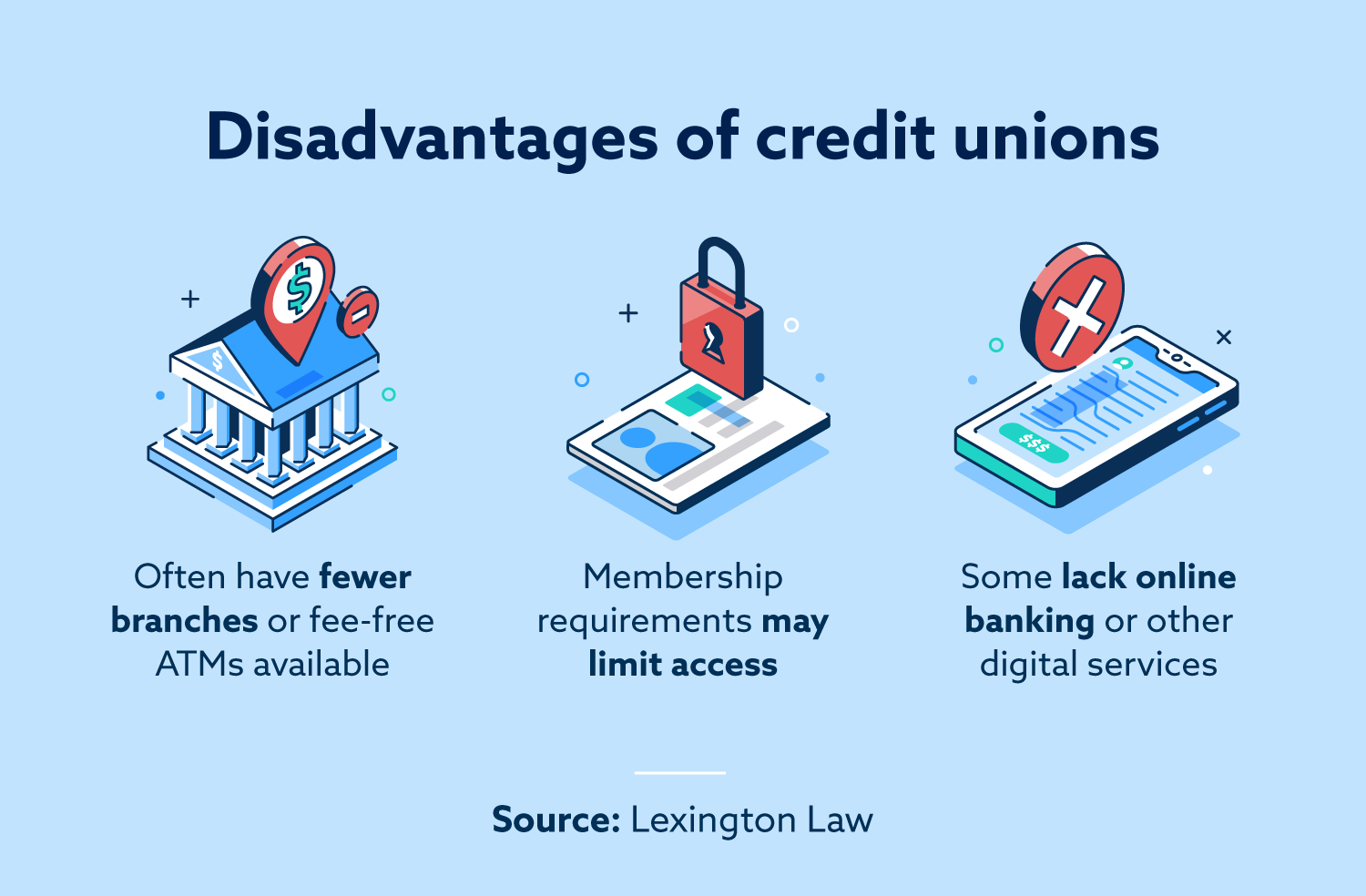

2. Borrowing from the bank unions

Regional credit unions can be a selection for a financial investment property HELOC. This type of user-possessed institutions can often be far more flexible and offer better pricing than just conventional banks. Keep in mind that the financing union may need one to become a beneficial affiliate very first because of the starting a bank account with a little put prior to they approve the loan.

Particular on line lenders specializing in a home investment, along with HELOCS into the resource attributes, are seen recently. An online bank will likely be an effective selection for people, because they usually have even more easy qualifications standards the real deal home dealers.

Choice sourced elements of funding

Whenever you are a line of credit is a good idea for your needs, it’s not the sole particular investment property mortgage offered. Here are a few options to adopt:

Cash-aside refinance

An earnings-aside refinance try replacing your existing home loan with a new, big mortgage and you will taking the difference between cash. This will make you a lump sum payment regarding money having expenditures and other costs but may produce high monthly mortgage payments and extra settlement costs.

Opposite financial

Having traders more than 62 who individual its resource properties outright, an opposing home loan can provide a way to obtain tax-free income by the tapping into this new collateral within their functions. You need to be aware that opposite mortgages is complicated and also have high charges and you can restrictions.

Unsecured personal bank loan

Should your money spent has no enough equity, you can think a personal bank loan. Yet not, given that lenders do not safer so it loan method of that have possessions, it tend to deal large rates.

Cross-collateralization mortgage

Such mortgage enables you to use the equity from multiple investment qualities since the equity to own just one financing. It does render greater borrowing from the bank stamina but may and additionally introduce way more of one’s property so you can potential exposure.

Personal line of credit to the leasing possessions

A line of credit on your invested interest possessions shall be a good rewarding monetary equipment, that delivers the flexibility and you can usage of you need for the a property spending organization.

Talk about the many lines of credit to choose its complement your circumstances. Understanding the advantages and disadvantages can help you determine whether that it financing alternative aligns along with your financial support requirements and you can risk tolerance.