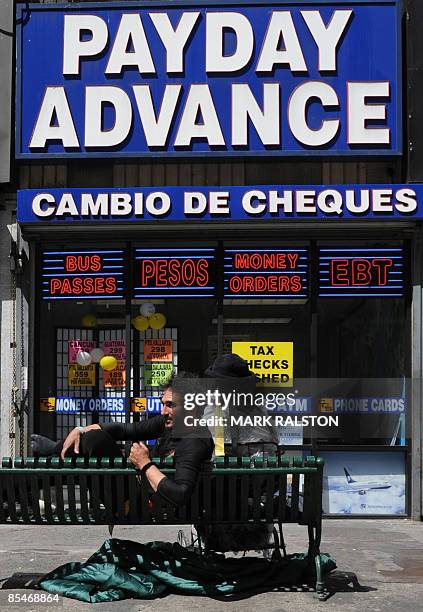

You happen to be that have many wants, wishes, and aims in life. But finance tend to becomes a regulation in order to for example desires. Here’s when a personal bank loan comes into the picture. Signature loans is actually finance that you can get in place of taking one protection. Because it’s a consumer loan, loan providers pursue a rigid borrowing from the bank review processes before offering financing. They will certainly look at your paycheck, capability to pay-off debt, credit history, an such like. Predicated on such details, might determine whether they will be give you an unsecured loan or perhaps not.

We can declare that personal loans is financing against all of our earnings. It is they you’ll discover an unsecured loan regardless of if we have been out of work?

It could come since a shock for you but yes! You can aquire a consumer americash loans Memphis loan even if you is unemployed. Let us find out how!

Personal loans Without a job

The sort of loan you are offered is part of secured finance, government financing strategies towards unemployment, and you can pay day loan. Let’s find out how you should buy an unsecured loan instead good job:

1) Government Loan Techniques to possess Underemployed

Government entities possess initiated individuals loan systems in order to satisfy this new economic means off underemployed some one. Following the are among the unsecured loan schemes that you can take advantage of even though you lack a career:

- Pradhan Mantri Rozgar Yojana: This program is actually started especially in order to satisfy the needs of the unemployed. They focuses primarily on taking money to enable underemployed individuals begin their own solutions.

- Financing Subsidy To own Underemployed: This new Tamil Nadu bodies started a program entitled The Entrepreneur and you can Organization Creativity Strategy (NEEDS). The federal government provides a 25% subsidy towards finance provided to graduate out of work youths.

- Agricultural Loan On the Out of work: The government keeps collaborations with various banking companies to include agricultural money towards the out of work. It loan might be utilised when it comes down to farming enterprise.

Its also wise to below are a few almost every other main and you may state government strategies that will help you score unsecured loans. Speak to your nearby financial otherwise Piramal Funds for more information on such plan.

2) Financing Against Book And Interest Income

For availing of unsecured loans, it is important that you really have a steady source of income. Even though you lack work but are generating good rental earnings otherwise attention money, next financial institutions will get give your a personal bank loan. These types of earnings are very well experienced of the financial having providing you unsecured loans. Along with, almost every other resources of passive money is deemed so you can get the personal loan approved.

3) Personal loan Facing Property

If you’re unsecured loans is actually unsecured in general, you can require a secured personal bank loan by giving people cover. Finance companies can undertake the safety and provide you with a personal bank loan. When you are giving the loan, the bank usually charge you secure deposit against the loan. The lending company tend to seize this count or even pay the newest loan perfectly. For this reason they want security before you make funds.

In your case, since you don’t have a constant revenue stream but i have repaired dumps, this can work very well due to the fact coverage. The lending lender offers from the sixty-80% of the value of their repaired put once the financing. Your whole fixed put can consistently earn focus due to the fact in advance of.

Particularly, state you want financing of Rs. 25,000 up against their repaired put away from Rs. step one lakh. You can get anywhere between Rs. sixty,000 and you can Rs. 80,000 facing their fixed deposit. Their demands, but not, is only Rs. twenty five,000. The lending company often deduct the borrowed funds amount out of your deposit and you can give it time to always enable you to get money for the remainder of its tenure.

It’s also possible to use most other possessions in order to take advantage of signature loans particularly unsecured loan facing assets, gold, securities etc. so you’re able to avail of eg loans.

How to Pay off the loan

Typically, the length of a personal loan is actually a dozen-60 days. You are allowed to pay back the loan centered on your own capacity. not, try to improve a figure to conveniently repay every month when you look at the period of the mortgage.

Make use of bank’s unsecured loan EMI calculator to determine the matter you ought to shell out per month. You simply need to enter the unsecured loan number, period and personal mortgage rate of interest. You can get knowing the actual number of personal bank loan EMI that you will have to fund your personal financing.

Qualifications Criteria to own an unsecured loan

- Your credit rating

- The tenure while the a customers on lender

- Whether your costs previously was indeed typical and you may complete

Risks of Taking out that loan When Out of work

Thought well before you’re taking aside an unsecured loan if you don’t have a position. At all, you have zero constant income source now. Since the lender offers you the borrowed funds, it does expect to get the month-to-month instalments you promised to make. In case you overlook unsecured loan EMIs, then pursuing the consequences can also be realize:

You could potentially Face Monetary Trouble

The fact need financing means you may have a definite cost plan. If you do not pay per month because you promised, you can get many economic trouble. So, believe smartly just before opting for financing.

As well as, you could work for a couple of hours a day on the web or traditional and create an income source comparable to your instalment.

You could Lose The Shelter

Because of the failing to pay your repayments every month, you could potentially dump their safeguards. Likewise, you’ll have to pay additional focus.

Your credit score Might possibly be Hurt

Later money otherwise unusual instalments you are going to damage your credit rating, therefore feel careful from using because of the go out your promised. As well as, spend the money for assured amount every month.

Achievement

Commonly you relieved which exist a financial loan even though you don’t have employment? You truly must be. Now what you need to perform should be to verify that your may an unsecured loan courtesy the significantly more than 3 implies.