To shop for a house was an exciting day, but finding the bucks to have a deposit or the correct financing is complicated. Of these looking at a good 401(k), it’s appealing so you’re able to ponder Do i need to explore my 401(k) purchasing a home? As the response is yes, understanding the effects involved is a must to have financial profits.

A guide to good 401K

Before thinking about Do i need to explore my personal 401(k) buying property?, you need to have a very good knowledge of what this type out of account are. Its not all membership not as much as it name is the same. According to your lender together with account-particular guidelines affixed, you have got another type of sense being able to access money from so it membership.

- Withdrawing through to the age of 59? is sold with charges.

- Distributions and benefits are restricted to the government.

- You’ll find taxation gurus to own causing your account.

- To own withdrawing, you will see an effect on their fees.

All of these preferred issues help reach the goal of an effective 401(k), that will be to set up to own retirement. The government incentivizes with such membership to make certain that anybody will be off the beaten track when they retire. Which have generally highest rates out-of get back, tax holidays getting contributions, and you will boss share fits, the government implies maybe not coming in contact with that it account prior to retirement.

Finance compared to. Withdrawals

After you have reached the minimum decades having freely opening the 401(k), you could potentially play with that make up to find a house. Putting your 401(k) into a home might not be the best tip for the long-name upcoming you need to have old-age currency to live, anyway. However for people who have a good number of offers, to order a property along with their 401(k) could be the most practical way first off old-age.

While you are more youthful than simply 59?, the choices for opening your own finance are limited by possibly distributions otherwise finance. Discover benefits and drawbacks to each method. Why don’t we check each.

Loans

For those seeking grab from an effective 401(k), a loan is usually the most suitable choice. That is because you will find few charges towards membership and you may their taxation, but just remember that , it is just financing and also the number need to be distributed right back with focus.

Additionally, you can aquire truly money aside and you may everything pay off will not be regarded as a sum. Thus because the means to fix Must i play with my personal 401(k) to buy a home? is actually yes, even the best choice to get it done is hurt your financial future.

- No detachment penalty.

- Zero tax to invest about what you obtain.

- You need to pay the borrowed funds add up to this new account with desire.

- The common fees period is only 5 years.

- Payments aren’t sensed efforts, so there isnt a taxation crack readily available and no employer match.

Withdrawals

Should your factor in your withdrawal qualifies due to the fact an urgent you prefer or difficulty , you do not happen charges. However, otherwise satisfy people criteria, you’ll have to spend a beneficial ten% punishment to the any sort of amount you’re taking. There are also to blow fees with this amount as the earnings.

Even if the words have a look certified to you, you must check out the impression regarding shrinking pension savings. The chance of development in an effective 401(k) is large. Depending on the financing around, you may find that you’ll spend notably less in desire historically than what your finances helps make on your 401(k).

Such as for instance, you could potentially put $fifty,100 on the a house. However, if it stays in their 401(k) to your twenty five years it might take to fund your house, that cash you certainly will build at a level of 7% to over $270,one hundred thousand. This may entirely transform just what lifestyle looks like inside the old-age.

Options to presenting Your 401(k)

Must i have fun with an excellent 401(k) buying a house? is never their sole option. Even though you don’t possess a large amount of discounts aside from your retirement fund, that doesn’t mean you cannot pick an option to have paying for a house.

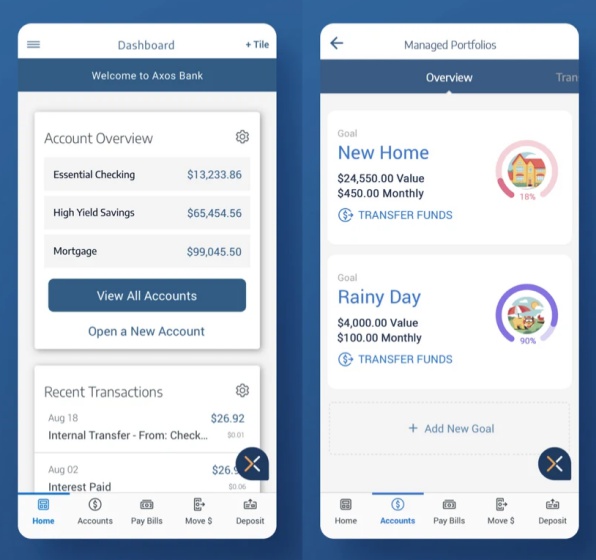

In the event you just do not have the cash initial purchasing a property, there are numerous financing solutions. It does not matter your current items, you will find an easy way to have the financial assistance necessary for to order a property.

It is very important do browse towards the financing choices, due to the fact some loans have friendlier terminology than others. Such, you may find that a fixed home loan can get you purchasing less in the long term than just an FHA loan. For some, they may also understand one to withdrawing from their 401(k) is best choice after all loans in Riverside.

Consult an expert loan advisor for additional info on evaluating words, interest levels, and you will consequences. Might help you know very well what are working an educated getting your current financial items.

Do i need to use my 401(k) to purchase a home? Sure. Whenever you really have a lot of cash in your 401(k) membership, it may seem foolish never to place it so you can good explore. not, the consequences regarding extract prematurely from this sorts of account can be getting severe. You don’t want to enter into retirement in the place of adequate money having the approach to life you would like.

But even although you get a hold of good 401(k) isn’t the best method to pay for the acquisition of your home, there are still an approach to get the domestic out of your aspirations. Contact brand new Associates Mortgage team, and you will learn about the way to get the bucks you prefer having your brand new family.