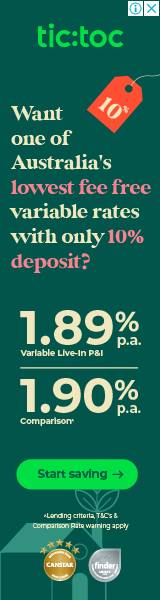

With many other financial available options today, this new desire to Mansfield Center loans acquire or design a house for the majority of is no more a faraway you to definitely. Interest levels have likewise decrease drastically over the years, which have loan providers for example you during the PNB Property providing aggressive financial interest rates . But not, most lenders lend up to a total of 90% of property’s really worth. This has been required by the Set-aside Bank away from India/NHB assistance.

Thus, the rest 10% must be offered given that a down-payment . According to value of the house, this down payment could possibly get changes. This means that, when your property value you reside large, brand new down-payment will increase too. In this situation, it might rating challenging if you don’t have enough money on the bank account. Therefore, issue comes up:

Strictly speaking, the solution isn’t any. But not, there’s specific selection to assist you program the earnings necessary for the brand new downpayment more efficiently and easily.

Finance with no Downpayment

According to the property’s really worth, you will need to strategy the fresh deposit. A few of the most repeated ways of acquiring funds to own a beneficial downpayment on the a house are listed below:

When you have a working resource collection, you could use your mutual money, repaired deposits , etc., to make the downpayment. Although not, it is advisable simply to have fun with expenditures that are not producing large show otherwise establish one income tax pros.

dos. Carry out Correct Considered

Best thought will be extremely beneficial in deciding to make the advance payment. Because of it, it is crucial setting aside a specified portion of their month-to-month money. You’ll be able to if you take money in common money, repaired dumps, silver, an such like. The idea is the fact that the monetary weight because of the down payment shouldn’t overwhelm your, and you may best believe facilitate prevent one.

3. Liquidate several Assets

This procedure can help in the make payment on down payment. Any resource you could quickly liquidate will get into this category. Including current property, conveniently tradable ties, non-bodily assets, an such like.

4. Take the Assistance of Family unit members otherwise Members of the family to cover your Project

Anybody consider it since the final thing they may be able would, nevertheless actually so bad when you think it over. The good thing is you need not spend any notice into the currency your borrow. Since the an advantage, you may not need to bother about late charge if you find yourself late with your costs. Ergo, while getting a mortgage instead a down payment may not end up being you’ll be able to, you could potentially pay back new deposit together with your treasured ones’ help.

5. Taking out a loan or Get better out of your Providers

Particular companies keeps options for staff in order to avail funds so you can fulfil instantaneous financial need. For this, you need to affect the fresh Hr company of your own company in order to be in-breadth details of new policies. It may be the case that you must divulge particular proof your browsing get a home loan .

Although there are solutions to you if this concerns organising money for a down payment, you will find some points to consider.

- Taking right out a special Financing Will be Tough: You currently removed a home loan and ought to create into-big date repayments to help keep your credit rating unchanged. Taking out a zero down-payment financial you’ll put you inside the an economic join.

- Taking Funds from Members of the family Could have Unintended Outcomes: The simple truth is that in the event that you borrow money from your loved ones, you will never have to happen anything else. Although not, if you don’t pay-off your debt, the ones you love connections gets into the dilemmas.

- Secured loans Might Jeopardise your Property: When you take aside a loan facing safety, you devote the newest property at stake. Before applying for just one ones fund, reconsider that thought.

Latest Conditions

To prevent the dangers in the list above, you may want to bundle ahead of time before you buy a house instead of an advance payment to consider as part of the mortgage. This is usually better to can pay for regarding family savings so that you won’t need to move to most other mortgage possibilities when it comes for you personally to pay back the rest of your financing. Consequently, your weight could well be faster, and will also be capable buy your finest household without fretting about the fresh down payment.